Struggling with manual accounting tasks? These 5 AI tools can save you time, reduce errors, and cut costs:

- AI Meadow: Automates data entry, transaction categorization, and reconciliation. Works with QuickBooks and legacy systems. Scales as your firm grows.

- CountingWorks PRO: Streamlines tax prep, document reviews, and client interactions. Offers marketing tools and saves 4–5 hours daily.

- Y Meadows: Handles invoice processing, data entry, and compliance tasks. Integrates with payroll, CRM, and accounting tools.

- Botkeeper: Combines AI with human oversight for bookkeeping. Saves 10–15 hours monthly and integrates with QuickBooks/Xero.

- Xero AI Features: Built into Xero’s cloud platform. Automates invoicing, categorization, and cash flow forecasting. Affordable starting at $2/month.

Quick Comparison:

| Tool | Key Features | Integration | Cost-Effectiveness | Scalability |

|---|---|---|---|---|

| AI Meadow | Automates data entry & reconciliation | QuickBooks, legacy systems | Saves time, reduces errors | Grows with workload |

| CountingWorks PRO | Tax prep automation, marketing tools | CRMs, accounting tools | Saves 4–5 hours daily | Scales with client base |

| Y Meadows | Invoice processing, compliance tasks | Payroll, CRM, accounting tools | Reduces manual workload | Adapts to growth |

| Botkeeper | Bookkeeping automation, human review | QuickBooks, Xero, Zapier | Saves 10–15 hours monthly | Handles seasonal spikes |

| Xero AI Features | Invoicing, categorization, forecasting | 1,000+ apps, payment platforms | Starts at $2/month | Learns from data growth |

AI tools can transform small accounting firms by automating repetitive tasks, improving accuracy, and saving time. Start small - pilot one tool to see the benefits in action.

15 AI Tools Smart Accountants Are Using Right Now

1. AI Meadow

AI Meadow is tailored specifically for small U.S.-based accounting firms with 5 to 20 employees. It focuses on simplifying the most time-intensive parts of monthly accounting workflows, freeing staff from manual tasks so they can concentrate on client advisory work. Let’s break down how its automation features and integration capabilities make it a game changer.

Automation of Repetitive Accounting Tasks

One of AI Meadow's standout features is its ability to handle repetitive tasks like data capture and transaction categorization. The tool automatically gathers source documents - such as receipts, invoices, and bills - and extracts critical details like vendor names, amounts, and dates. It even suggests general ledger categories for each transaction, streamlining the entire process.

This automation cuts down invoice processing time by up to 80%. For firms managing hundreds of transactions every month, this translates into saving dozens of hours - time that can be redirected toward more strategic, client-focused activities.

Another area where AI Meadow shines is reconciliation and month-end close. It compares bank and credit card transactions against the accounting ledger, flagging discrepancies, duplicate entries, or missing adjustments. The tool also suggests common journal entries for items like interest income and fees. With ongoing reconciliations, it prevents last-minute surprises at the end of the month, keeping everything on track.

Integration with Existing Accounting Software

AI Meadow integrates seamlessly with popular accounting platforms like QuickBooks, feeding clean, processed data directly into the system. This means firms can adopt automation without overhauling their existing workflows or investing in extensive retraining.

Whether firms use modern cloud-based systems or older legacy software, AI Meadow works with both. By automating data entry, it reduces the risk of human error while also minimizing the IT challenges that often come with new technology projects.

A Cost-Effective Solution for Small Firms

For small accounting firms, every dollar and hour counts. AI Meadow helps these firms maximize their resources by automating routine tasks, allowing teams to focus on providing strategic client services. This approach not only saves time but also delivers financial benefits by keeping operations lean and efficient.

Built to Scale with Growing Businesses

As firms grow their client base or expand their services, AI Meadow scales effortlessly to handle the increased workload. The platform manages higher transaction volumes without requiring firms to hire additional staff, helping them maintain healthy profit margins while increasing revenue.

This scalability is particularly important as the accounting industry evolves. A significant 71% of accounting professionals believe AI will transform the field, and the sector is expected to see AI adoption grow by 30% annually through 2027. With AI Meadow, small firms gain a tool that evolves with their needs, ensuring they stay competitive and efficient in a rapidly changing market.

These capabilities make AI Meadow a powerful ally for small accounting firms, setting the stage to explore even more AI-driven tools in the industry.

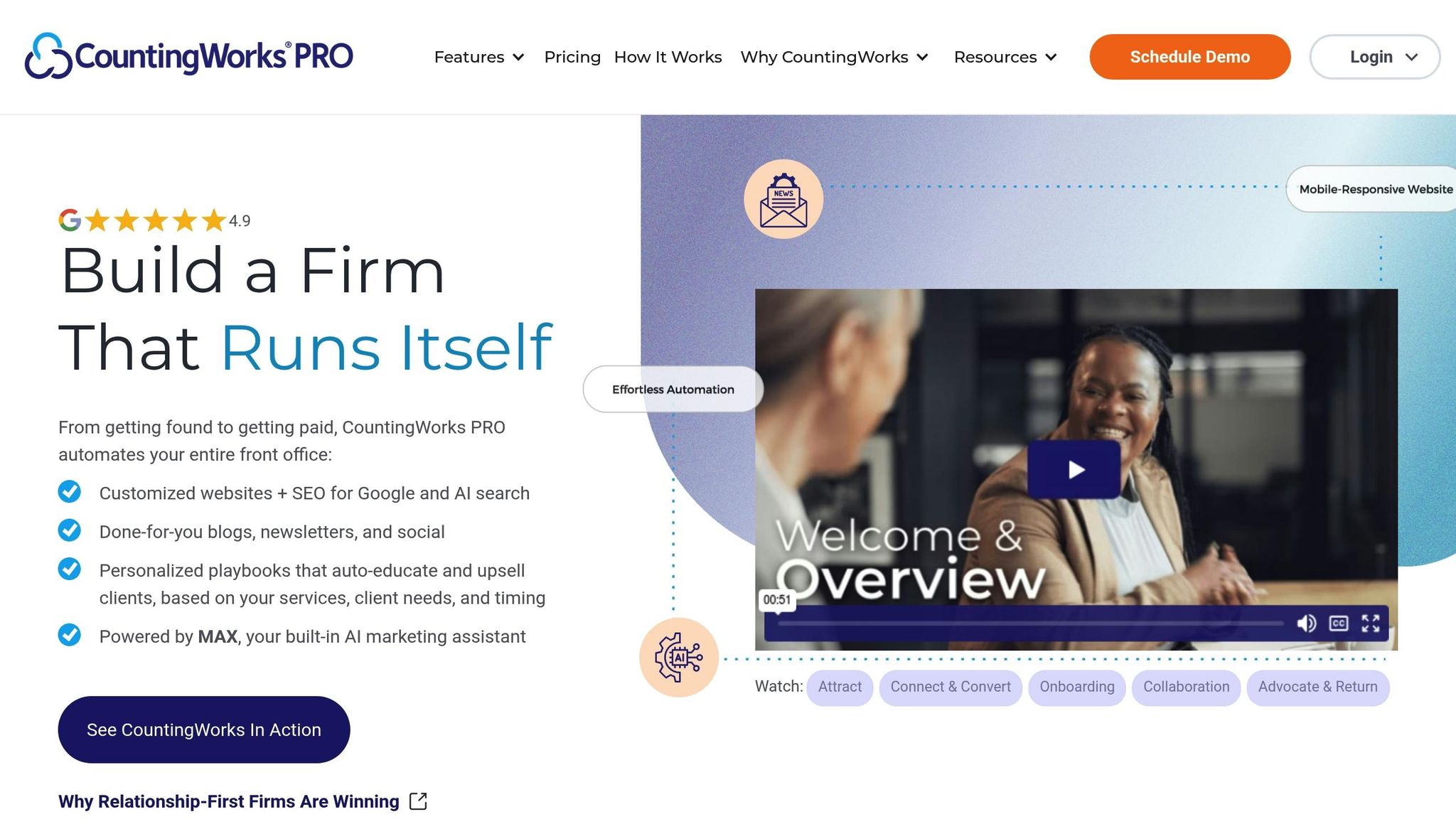

2. CountingWorks PRO

CountingWorks PRO simplifies front-office operations for tax accountants and small accounting firms, helping them build stronger client relationships and grow their businesses without adding staff. Let’s dive into how CountingWorks PRO streamlines tasks, integrates with existing tools, and supports growth.

Automation of Repetitive Accounting Tasks

CountingWorks PRO eliminates many manual accounting tasks, giving professionals more time for strategic work. For instance, its automated tax work paper preparation can save tax professionals 1–2 hours daily.

The platform also processes PDFs and webpage content for document review, while automating routine interactions like scheduling. These features can reduce manual efforts by up to 40%. Altogether, the combination of AI-driven automation and comprehensive tools can save accounting professionals 4–5 hours every day. This extra time allows small firms to take on more clients without compromising service quality.

Integration with Existing Accounting Software

CountingWorks PRO works seamlessly with existing systems, thanks to API integrations that improve data flow and functionality. These integrations connect the platform with CRMs, accounting tools, and legacy systems, ensuring smooth adoption without disrupting established workflows. By linking technology across daily operations, CountingWorks PRO creates a solid foundation for firms to scale their services.

Cost-Effectiveness for Small Firms

CountingWorks PRO combines website design, marketing, and SEO into one package, saving firms the cost and hassle of managing multiple vendors. CPA Practice Advisor awarded the platform a 5-star rating, noting its "best value-to-cost metrics". Flexible pricing options make it accessible for firms of varying sizes.

The results speak for themselves. Firms using CountingWorks PRO see up to 3× more website traffic within 90 days, which directly boosts lead generation and client acquisition. Terry O'Neill, a tax preparation service provider in Virginia, shared how the platform helped him maintain a steady workload throughout the year - something he struggled with before.

"CountingWorks transformed how I show up online. I went from invisible to page-one rankings - and I didn't lift a finger."

– Chris M., CPA

Scalability for Growing Businesses

Beyond its efficiency and affordability, CountingWorks PRO grows alongside your firm. As your client base expands, the platform scales to handle increased demands without the need for extra staff. Its AI tools assist with drafting client replies, creating landing pages, and writing proposals, cutting down the time required to deliver professional services. Automation covers everything from scheduling and document requests to status updates and follow-ups.

"I finally feel like my website, content, and client onboarding are working together. I look like the pro I am."

– Lisa R., Enrolled Agent

CountingWorks PRO also empowers smaller firms to build professional, agency-level brands without the hefty price tag. With customizable website designs and polished narratives, firms can present themselves on par with larger competitors. This combination of professional presentation and automated processes positions small firms for sustainable growth in competitive markets.

3. Y Meadows

Y Meadows is making waves as an AI-driven solution tailored for small accounting firms aiming to reduce manual workloads and cut costs. By automating repetitive tasks, it allows accountants to shift their focus to strategic analysis and delivering higher-value services to clients. Following in the footsteps of tools like AI Meadow and CountingWorks PRO, Y Meadows is another example of how targeted automation is reshaping accounting practices.

Automating Routine Accounting Tasks

One of Y Meadows' key strengths lies in its ability to handle repetitive tasks such as invoice processing, data entry, and report generation. This not only improves accuracy but also significantly reduces the likelihood of errors. Additionally, the platform automates workflows like account reconciliation, helping firms stay tax-compliant without requiring constant manual intervention.

Seamless Integration with Accounting Tools

Y Meadows integrates effortlessly with widely-used accounting software, as well as other essential systems like payroll, CRM, and point-of-sale solutions. This integration streamlines operations by allowing firms to import existing data - such as charts of accounts, invoices, bills, and contact details - without any hassle.

A Cost-Saving Solution for Small Firms

In an industry grappling with staffing challenges - 85% of firms report difficulty hiring finance managers, and 300,000 accountants left the workforce between 2020 and 2022 - Y Meadows offers a way to maintain service quality while operating with leaner teams. As Logan Graf, CPA, aptly puts it:

"AI is taking our jobs... No, AI is only taking the work that we don't want to do. So let's try to reframe how we think about AI."

The urgency to embrace AI is echoed by Shahram Zarshenas, CEO of Financial Cents, who warns:

"I believe that a lot of the firms that don't adopt AI could fall behind because other firms that adopt it will be able to provide a better client experience. They will be more efficient and profitable and can reinvest their time to grow more effectively."

Supporting Business Growth

Y Meadows isn't just about automation; it’s designed to scale alongside growing businesses. By efficiently managing increasing workloads, the platform helps firms maintain high service standards. With 71% of accounting professionals predicting that AI will bring major changes to the industry, and the AI accounting market expected to leap from $6.68 billion in 2025 to $37.60 billion by 2030, early adopters of tools like Y Meadows are positioning themselves to lead this transformation. This shift underscores the growing reliance on AI to boost efficiency and reduce costs in the accounting world.

sbb-itb-ca9a050

4. Botkeeper

Botkeeper blends the power of AI with human oversight to handle bookkeeping tasks, reducing manual effort and maintaining exceptional accuracy.

Automation of Repetitive Accounting Tasks

Botkeeper takes care of essential bookkeeping chores like transaction categorization, payroll, bill payments, financial reporting, invoicing, and revenue recognition. By automating these tasks, it saves teams countless hours each week. With an AI accuracy rate of 99.97%, the platform integrates directly with QuickBooks Online or Xero ledgers using GL Automation. Additionally, its Bot Review system identifies and flags discrepancies or exceptions in the general ledger for human review.

"Our entire goal is to make the accountant's life easier by removing them from the tedious - yet essential - bookkeeping process." – Botkeeper

Small firms using Botkeeper report saving around 10–15 hours per month on bookkeeping tasks, giving them more time to focus on client advisory services and growing their businesses. This automation aligns effortlessly with existing workflows, making it a seamless addition to any team.

Integration with Existing Accounting Software

Botkeeper works hand-in-hand with QuickBooks Online and connects to thousands of other apps through Zapier. Its Smart Connect tool simplifies the process of linking clients' financial data, eliminating the need for manual logins. This streamlined integration allows firms to maintain their current workflows without requiring extensive retraining. Users have rated the platform 4.4 out of 5, highlighting its smooth client onboarding process and timely reporting features.

Cost-Effectiveness for Small Firms

On average, Botkeeper clients save 45% compared to traditional bookkeeping methods. This makes it an appealing option for firms aiming to boost profitability without compromising service quality. The "Infinite package", a tech-only solution, is priced at $69 per entity per month with flexible month-to-month billing. Volume discounts further reduce costs, while improved accuracy minimizes errors. As one client put it:

"It's cheaper, faster, and more accurate than any other bookkeeping company…it's a no-brainer." – Botkeeper Client Testimonial

Scalability for Growing Businesses

Botkeeper isn't just cost-effective - it grows with you. Its advanced AI capabilities enhance efficiency by 60% when integrated with QuickBooks Online and save clients 25% of their bookkeeping time. This scalability is especially useful for firms experiencing rapid growth or seasonal workload spikes, as the platform adapts to changing needs without requiring additional hires or significant training investments.

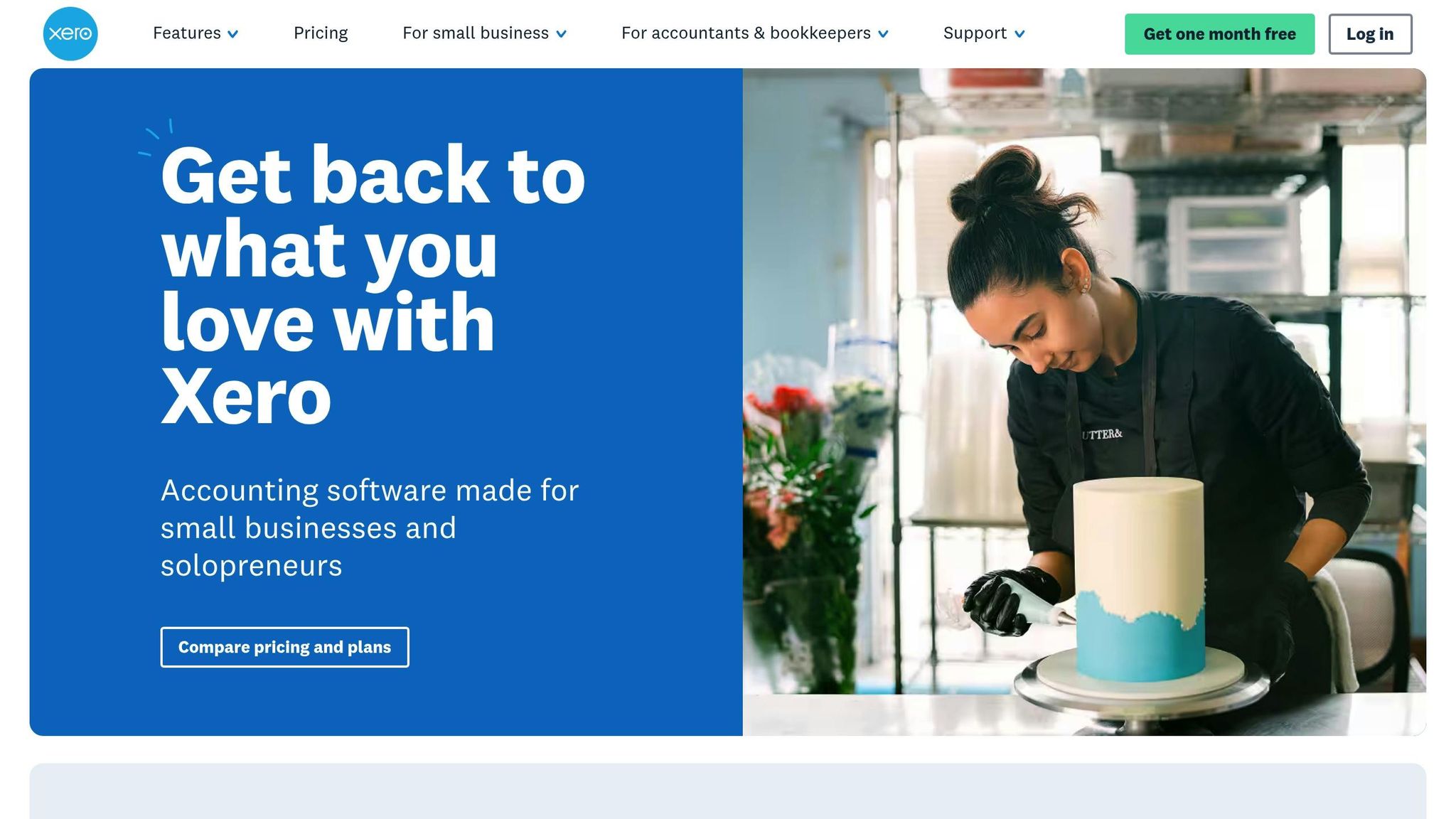

5. Xero AI Features

Xero brings artificial intelligence directly into its cloud accounting platform, which serves 3.95 million subscribers. This integration helps small businesses streamline daily tasks without needing to switch platforms.

Automation of Repetitive Accounting Tasks

Xero's AI simplifies tedious accounting tasks using OCR (optical character recognition) to pull key details from receipts and invoices. It automatically categorizes transactions based on historical data, speeds up bank reconciliations by matching bank feeds with records, and even suggests account codes while offering cash flow forecasts. In August 2024, Clooud Consulting highlighted how Xero's AI reduces manual data entry by auto-categorizing expenses and extracting receipt data, all while providing actionable insights for cash flow management.

Xero is also rolling out a feature called "Just Ask Xero (JAX)", which is designed to cut search times by 40% and reduce the need for follow-up sessions by 20%.

Integration with Existing Accounting Software

Xero's AI capabilities don't just stop at automation - they integrate seamlessly into broader workflows. The platform connects with over 1,000 business apps, including tools for payment processing, e-commerce, time tracking, HR, and payroll. This ensures a smooth flow of data and enhances overall functionality.

"AI already powers many of Xero's everyday features, saving our customers time and delivering them important insights. Our AI vision builds on our strong foundation of experience in building data-driven products, and holds true to the responsible data use commitments that guide our decisions." - Diya Jolly, Chief Product Officer at Xero

Third-party tools like SaasAnt Transactions further enhance efficiency by automating the bulk import and export of financial data between spreadsheets, e-commerce platforms, payment gateways, and Xero itself.

Cost-Effectiveness for Small Firms

Xero's pricing makes AI-powered accounting accessible for small businesses. Plans start at just $2 per month, with higher tiers offering additional features. This low entry cost allows small firms to take advantage of professional-grade AI tools without a hefty investment. By storing documents online and automating bank feeds, Xero also helps reduce physical storage costs and minimizes manual data entry.

With features like real-time financial insights and automated reporting, Xero simplifies training and speeds up adoption - 88% of users report that the platform is easy to use. Automated invoicing and integrations with payment platforms like Stripe and GoCardless further enhance cash flow by enabling faster payments. These features make Xero a cost-efficient solution that supports small businesses as they grow.

Scalability for Growing Businesses

As your business grows, Xero scales effortlessly to meet increasing demands. Its extensive app marketplace and flexible features allow AI automation to handle higher transaction volumes without requiring additional staff. Real-time financial insights provide visibility into performance metrics, helping you identify growth opportunities.

"We love that Xero integrates seamlessly with our Shopify stores, our payroll and that we can use it for invoicing some of our larger customers directly. It also gives us an easily accessible snapshot of our business performance and helps us understand our cash flow." - Becca Stern, Co-Founder of Mustard Made

Xero's cloud-based system ensures that your team can access financial data from anywhere, making it ideal for remote work and collaboration across multiple locations. As transaction volumes increase, Xero's AI continuously learns from historical data, improving its accuracy in categorization and forecasting.

"Technology has changed the lives of small businesses dramatically - first with cloud accounting, then automation, and now through GenAI. We're embracing this new wave of tech innovation responsibly, with our customers at the heart of what we do, as we deliver on our vision to be the most trusted and insightful small business platform." - Diya Jolly, Chief Product Officer at Xero

Conclusion

The accounting world is evolving rapidly, with 60% of firms already leveraging AI to automate tasks and support strategic decision-making efforts. For smaller firms, AI presents a game-changing opportunity to level the playing field with larger competitors by reducing costs and boosting efficiency.

Success with AI starts with strategic planning and phased implementation. Begin by analyzing your current workflows to pinpoint repetitive tasks that drain productivity. Whether it's data entry, transaction categorization, or month-end reconciliation, AI tools can take over much of the manual workload, freeing accountants to focus on more impactful, high-value services. This aligns with earlier examples of how automation has streamlined processes across the industry.

When choosing AI tools, focus on those that balance cost, functionality, and compatibility. Research shows that adopting AI can reduce costs by 46%, improve effectiveness by 40%, and deliver payback within seven months. Additionally, firms report saving over 25% of their time on reporting tasks alone.

Integration is just as critical as selection. Tools like AI Meadow and CountingWorks PRO highlight the importance of working with vendors that offer clear AI capabilities, strong customer support, and robust data security measures. Start small - pilot the software on a limited scale to allow your team to adapt without feeling overwhelmed. This gradual rollout helps ensure a smoother transition and demonstrates the tangible benefits early on.

The competitive advantage AI offers is clear. Shahram Zarshenas, CEO of Financial Cents, emphasizes this point:

"I believe that a lot of the firms that don't adopt AI could fall behind because other firms that adopt it will be able to provide a better client experience. They will be more efficient and profitable and can reinvest their time to grow more effectively".

With the AI accounting market projected to grow from $6.68 billion in 2025 to $37.60 billion by 2030, early adopters are positioning themselves as forward-thinking leaders who attract tech-savvy clients.

Training your team is crucial - AI should be viewed as a tool to enhance their skills, not replace them. Among firms already using AI, 42% report daily usage, and another 31% use it weekly. This frequent adoption underscores how quickly teams adapt when they see real-world benefits in their daily tasks.

FAQs

How can AI tools like AI Meadow help small accounting firms handle more work without hiring extra staff?

AI tools like AI Meadow are transforming how small accounting firms handle increasing workloads. By automating repetitive tasks such as data capture and transaction categorization, these tools make life a lot easier. For example, they can automatically collect documents, pull out key details like vendor names, amounts, and dates, and then categorize transactions - all with minimal manual input. This not only saves time but also boosts accuracy, allowing staff to focus on more meaningful work like advising clients and planning strategically.

AI Meadow also takes the headache out of reconciliation and month-end closing. It can spot discrepancies, suggest journal entries, and even handle ongoing micro-reconciliations. This makes the process faster, reduces the chance of errors, and keeps monthly operations running smoothly. With tools like these, firms can take on more work and meet client expectations without needing to grow their team.

How does AI Meadow integrate with accounting systems, and what benefits does it offer for firms using older or modern technology?

AI Meadow works effortlessly with both current and older accounting systems, streamlining tedious tasks like data entry and transaction categorization. It uses AI to automatically gather client documents, pull out important details - such as vendor names, amounts, and dates - and sync this cleaned data straight into accounting platforms like QuickBooks.

This process not only cuts down on manual work but also boosts accuracy and saves time. When it comes to reconciliation, AI Meadow matches transactions against the accounting ledger, flags any mismatches, and even suggests corrections, making month-end closings much smoother. Its adaptability makes it a perfect fit for firms sticking with older systems or transitioning to newer ones, offering efficient workflows without the need for a complete tech overhaul.

How can small accounting firms successfully implement AI tools to streamline their workflows?

To start integrating AI tools effectively, small accounting firms should first pinpoint tasks that are repetitive and take up a lot of time, such as data entry or reconciliation. These are prime candidates for automation, as AI can help streamline these processes and minimize errors.

The next step is to train your team to use these tools confidently. Encouraging an open attitude toward innovation is key here. By showing how AI complements their work rather than replacing it, you can help your team feel more at ease with the transition.

Lastly, kick things off with small pilot projects. Test the AI tools in a controlled setup, gather feedback, and adjust your processes as needed. Once you're confident in the results, you can expand the use of AI across your firm. Taking it one step at a time ensures a smoother transition and helps you get the most out of these new technologies.